What do members actually want from a health plan experience?

American health insurance has two major problems: member experience and rising care costs. Member experience can suffer when health plans aren’t sure what their members want or expect. However, Wellframe’s recent survey highlights some surprising trends in how members think about their health plans.

To give health plans a clearer picture of what members want, Wellframe commissioned a survey. More than 1,000 people across the U.S. with public or private health insurance responded.

Despite roadblocks and frustrations, many American consumers believe health plans are beneficial overall. Respondents believed health plans want to improve their health proactively, solve health issues quickly, and make life easier—providing a crucial opportunity for health plans to serve as the unlikely heroes of member advocacy.

2021 Health Plan Member Engagement Survey Results

Many survey respondents indicated they would utilize support services offered by health plans:

Navigating the healthcare system

Digital Advocacy

Personalized Care

A care advocate can help direct members to the right providers for their unique needs, and can help secure a referral

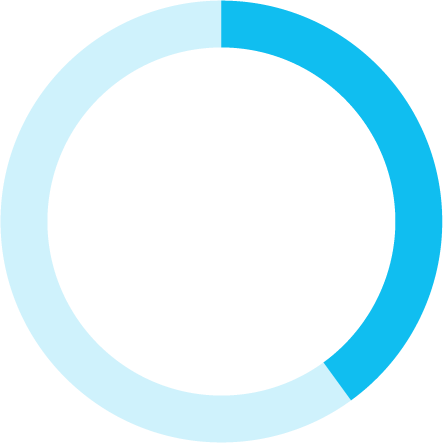

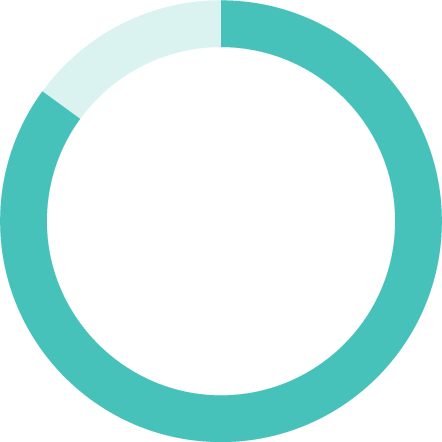

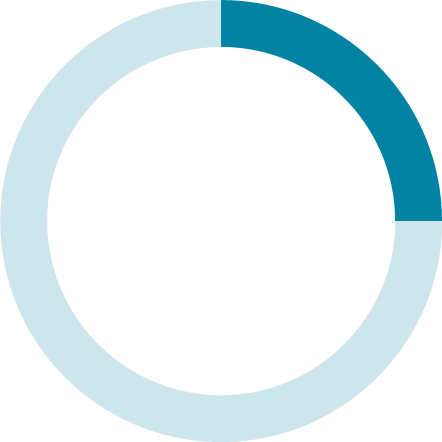

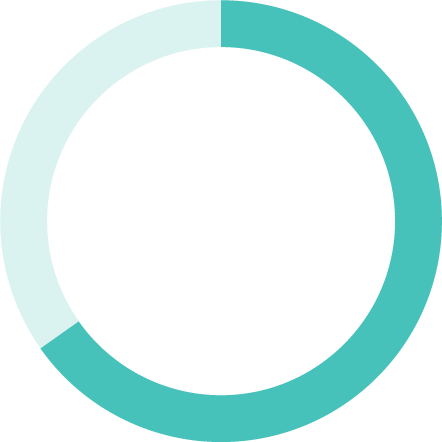

Said they would use a service that could help find and schedule an appointment with a doctor who would be best for specific health needs

Up from 80% in 2020

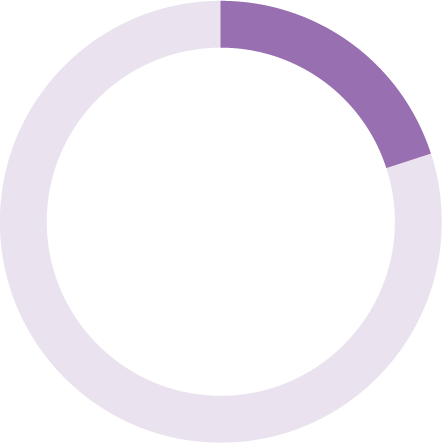

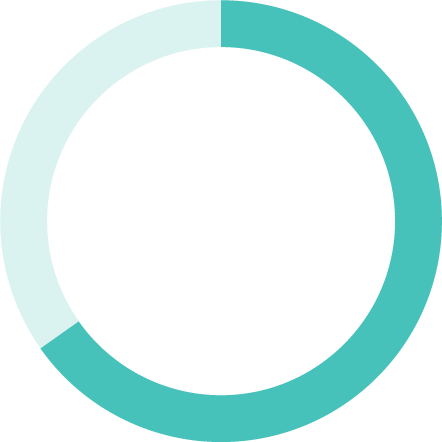

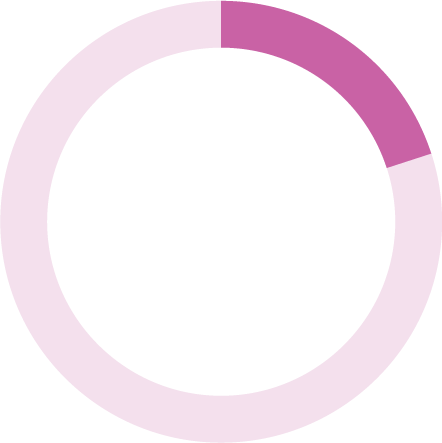

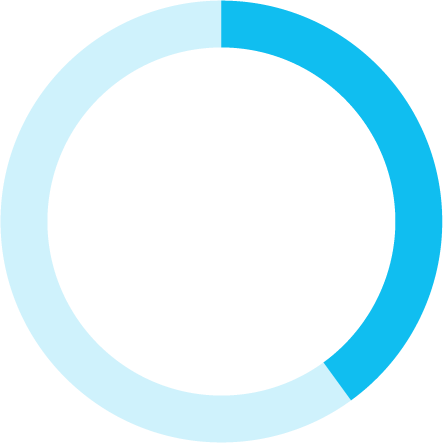

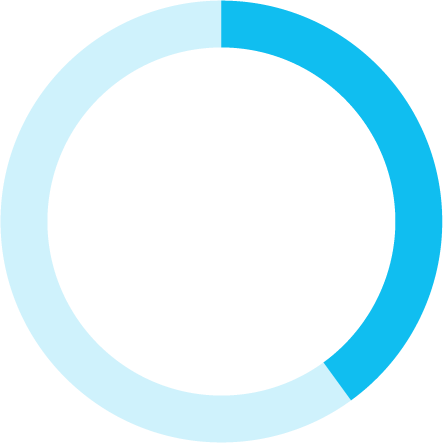

Said information and care they receive is too generic or not personalized.

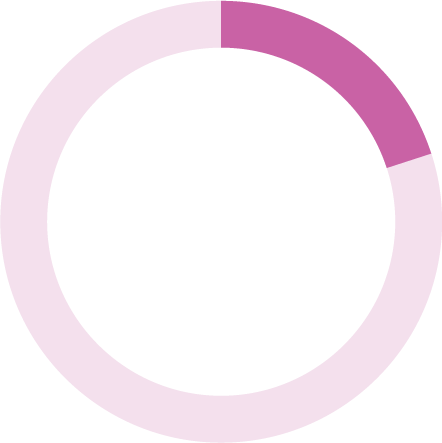

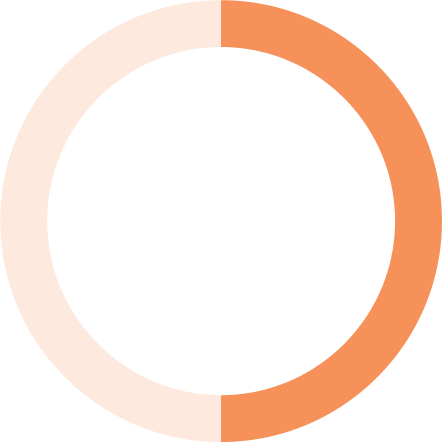

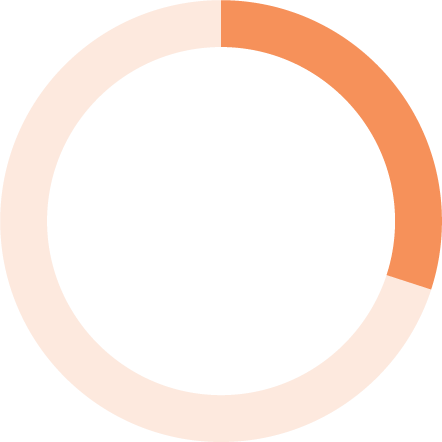

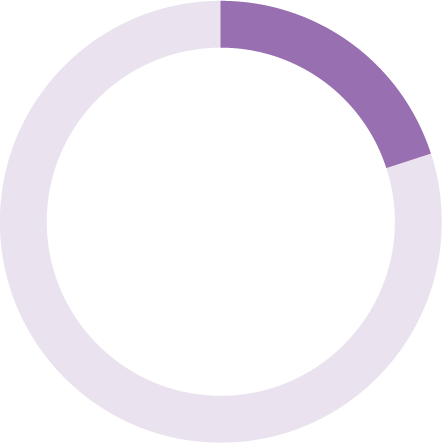

Said they disengaged from their healthcare when they didn’t have the availability to meet with a healthcare provider

Don’t think their healthcare insurance provider understands them and cares for their well-being

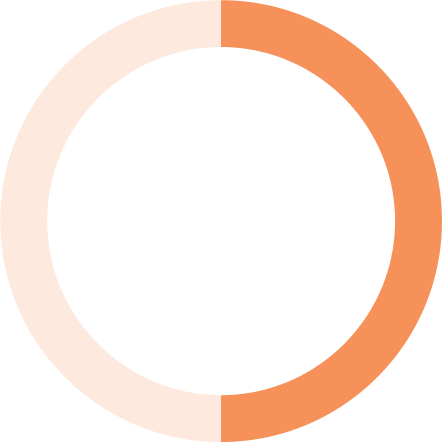

43%

Said they don’t understand their health insurance coverage and benefits.

19%

21%

49%

Down from 60% in 2020

85%

Members want more from their health plans—more personalization and more partnership.

The health plan experience suffers when members become too overwhelmed to self-serve and can’t reach the right staff members for answers. Digital advocacy solutions can help care teams explain benefits and send informational articles to more members than traditional phone outreach.

Compared to 2020, more members are receiving the personalized care they expect. And they’re willing to work with their care teams to access the right care.

Features like secure chat services allow for more consistent communication between care managers and members, promoting greater trust and more beneficial working relationships.

The study revealed that many individuals with chronic conditions are struggling to manage their health during the pandemic. Digital tools can help.

These members need additional support to better manage their own health between doctor visits. Care managers can use features like secure messaging and daily checklists to help keep members on track with their care plans, keeping them healthier and reducing the odds of readmission.

Supporting members with chronic conditions

50%

Condition monitoring, like taking a blood sugar measurement

56%

Medication reminders

65%

An explanation of benefits and eligibility

68%

Finding a care provider and appointment scheduling

Of those surveyed, 64% experience a chronic condition, with most common conditions being mood disorders, arthritis, asthma and diabetes.

One-third (35%) say they only proactively manage their health between doctor’s visits “somewhat well” or “not well."

64%

16%

17%

12%

12%

mood

disorders

arthritis

asthma

diabetes

45% of those with a chronic condition sought support from their health plan for mental health concerns during the pandemic.

One-third of respondents (35%) say they only proactively manage their health between doctor’s visits “somewhat well” or “not well.”

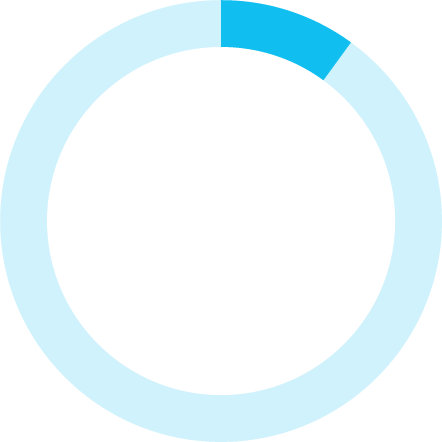

10%

Skip a step in their care plan daily.

20% skip a step weekly.

24%

Missed one or more appointments with a healthcare provider

26%

Forgot to take a dose of their prescription

47%

Would feel most inspired to take action on their health and well-being virtually (through a mobile app, by phone, via web, or via video)

Mental health barriers and reaching vulnerable members

Mental health

Vulnerable members

Social determinants of health, such as household income, can make it more difficult for individuals to manage their health and access care. But care management technologies can bridge the communication gap through two-way chat functions members can use and respond to at their convenience.

Didn’t have the availability to meet with a healthcare provider

22%

Had difficulty finding a healthcare provider and/or making appointments

31%

Have an annual household income below $20k

Physical health is deeply intertwined with mental health, and the pandemic has only exacerbated this issue for individuals with chronic conditions. However, holistic digital health tools may be the solution members need to manage their well-being.

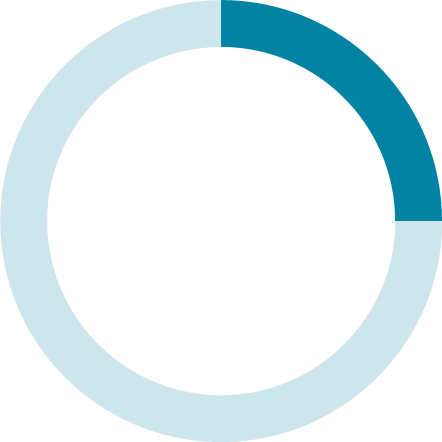

65%

Of members with mood disorders (depression, anxiety, etc.) sought mental health support from their health plan

38%

Have sought support from their health plan for mental health concerns since the start of the pandemic in March 2020

21%

Despite misconceptions, older Americans are interested in leveraging digital health technologies—and many are already using it. In fact, the median age of Wellframe users is 54, with nearly half of members being over 50.

Seniors and healthcare technology

43%

Digital health coaching, such as encouragement for nutrition and exercise

78% would use a service to help them find and schedule an appointment with a doctor who would be best for their specific healthcare needs

One-third of seniors say virtual care would most inspire them to take action on their health and well-being

The U.S. healthcare system has a ways to go before it is accessible to everyone. But we did notice several positive trends among survey respondents. Health plans are still in the right place to be healthcare’s unlikely heroes.

Bright spots

42% said they’d been frustrated when seeking help from their health plan.

However, most people believe insurance wants to:

42%

improve their

health proactively

solve health issues quickly

make life easier

60%

58%

52%

Health plans play a key role in supporting members and improving their experiences. Their leadership teams can coordinate with providers to ensure members have access to the information they need to make informed health decisions and make the most of their benefits.

Making the shift from sporadic outreach to a continuous journey can make all the difference for members living with multimorbidities. Health plans have the power to coordinate care teams and resources to maximize member reach and improve care outcomes.

Takeaway

52%

47%

Female

32%

18–34

years old

32%

35–55

years old

36%

55+

years old

Male

Wellframe worked with a third-party provider to collect responses from over 1000 U.S. adults with public or private insurance.

About this survey

Other

22%

Blue Cross Blue Shield

22%

United

Healthcare Group

14%

Aetna

8%

Anthem

5%

Cigna

4%

Wellcare

3%

Health Care Service Corp.

2%

MCNA Insurance

0.04%

Molina Healthcare

2%

Kaiser Permanente

5%

Humana

6%

0.62%

Non-binary

0.53%

Did not answer

61%

White

17%

Hispanic

14%

Black or

African-American

5%

Asian

1%

American Indian or Alaska Native

0.6%

Native Hawaiian or other Pacific Islander

1%

Did not answer

Are your members falling behind?

How can you engage senior members?

Seniors would use a virtual health tool that offered:

Plan breakdown:

Race breakdown:

Gender breakdown:

Age breakdown:

Interacting with members in more continuous and personalized ways keep them more engaged in their health and with their care teams. By leveraging digital health management, health plans are ideally equipped to close gaps in care and help their members live healthier, happier lives.

Deliver the seamless digital experience members demand.

Request a DEMO today

Health plans have the experience and resources to own their member relationships.

45%

26%

Without a chronic condition

With a chronic condition

64%

mood

disorders

16%

asthma

12%

diabetes

12%